In an earlier post we talked about the secret sauce for business success – planning. You can re-read the full post here, but the gist of it was this: businesses that thrive know where they’re going and how they’re going to get there.

· Where you’re going = your Strategic Plan.

· How you’re going to get there = your Annual Plan.

So, with your Annual Plan sorted (thanks to that planning session you made happen in January), what’s next for the ambitious business owner? Building your Budget and Action Plan.

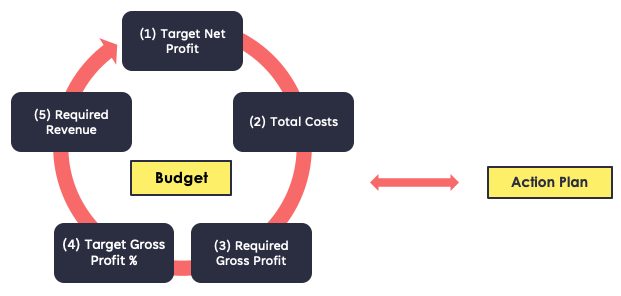

Think of your Budget as the financial roadmap for achieving your Annual Plan. We view budgeting as a circular, two-part process: Budget + Action Plan.

Having worked with a multitude of businesses over the years, we can attest that the Action Plan component is vital – without it, success is unlikely.

This edition of THRIVE will focus on Part One: Building your Budget. We’ll follow up in a fortnight with Part Two: Building your Action Plan.

Generally speaking, your Budget timeframe should align with your Annual Plan. We’re currently planning FY23 budgets with our clients: April 1, 2022 – March 31, 2023.

We begin by calculating (1) Target Net Profit and (2) Total Costs. These two are then combined to give you (3) your Required Gross Profit. From there we calculate (4) your Target Gross Profit Percentage, which will determine (5) the Required Revenue to achieve your profit goal.

Let’s look at each component, and how to work it out.

As a business owner, this is effectively your return on investment – the cash you are left with after your business has dealt with all the expenses at the end of the year.

How: Your Target Net Profit should be a combination of what you want to receive personally, plus a business investment figure – how much investment in your business will be required to stay relevant, keep progressing, build a shock fund and account for planned capital expenditure. If you are working in the business, we recommend including a market-rate salary in your cost structure, as this will ensure you have a profitable business if you want to hire someone to do your role.

This is the cost structure required to run your business and deliver your product and services. You’ll need to factor in fixed, variable, one-time and unexpected costs. Examples of fixed expenses include rent, salaries and insurance. Examples of variable costs include sales commissions and IT subscriptions.

How: Download your Profit & Loss report from Xero for the last 12 months. Export the report to Excel and sum each line item to give you an annual figure. Review and update these annualised figures for FY23, adding new lines as required. Sum your totals to give you your Total Cost figure.

In this situation, your Required Gross Profit is a combination of your Target Net Profit and Total Costs figures.

How: Add components (1) and (2) together. E.g. Target Net Profit $150k + Total Costs $70k = Required Gross Profit of $220k.

Your target Gross Profit Percentage (GP%) is the margin remaining after you have paid your cost of sales. E.g. For a builder, this would be revenue less materials and team labour costs.

How: To determine your target GP% for FY23, start by looking at what your GP% was in FY22, identify any improvements you’re going to make and decide on a realistic figure. This is an important value – you can’t just pull it out of a hat, you need to ensure that you can deliver on it. (And don’t forget about inflation.) For this example, we’ll use a target GP% of 45%.

Understanding your target GP% allows you to calculate the Required Revenue to achieve your Target Net Profit.

How: Divide Required Gross Profit (3) by GP% (4). E.g. Required Gross Profit $220k divided by GP% of 45% = $489k Required Revenue to achieve Target Net Profit of $150k.

And there you have it, the process for creating the first cut of your budget.

ACTION: Book two 90-minute sessions into your diary now – one next week and one the week after.

(Most folks tap out after 90 mins of finance 😉 Dedicate this time to pulling together the first cut of your budget.

A quick chat is often all it takes to get past a roadblock. Book a FREE 15 minute Check In call with Darrin or Paul at a time that suits you, and let’s get your budgeting back on track.

Budgeting gives you certainty and confidence. The ultimate benefit is that it puts you in control. It’s like turning your headlights on full beam – the obstacles in front of you are illuminated and you can navigate your way around them.

We hope this helps! Stay tuned for Part Two: Building your Action Plan – coming your way in a fortnight.